Gold was a disaster as an investment since it peaked at $1,900 an ounce in September 2011, falling more than $700 until its recent bottom below $1,200 in January 2014. However, gold has risen $150 in the past four weeks, a time period that coincides with China’s interbank credit crisis, the regime change in the Federal Reserve, a crash in emerging-market currencies and political violence in Ukraine, Thailand, Venezuela and Egypt, as well as a combat alert for Russian troops in Crimea. Is the rise in gold an ill omen for a macro black swan?

The international banking system has long recovered from the trauma of the 2008 Wall Street crisis and the eurozone’s bailout has led to a dramatic compression in Club Med sovereign debt yields. These were the two big macro risks that had led to gold’s meteoric rise to $1,900 an ounce in the first place. So it was only logical that the successful recapitalisation of global money centre banks (Citi, UBS, Merrill, RBS, Lloyds, etc.) crippled in the crisis and the containment of the EU debt crisis triggered a bear market in gold.

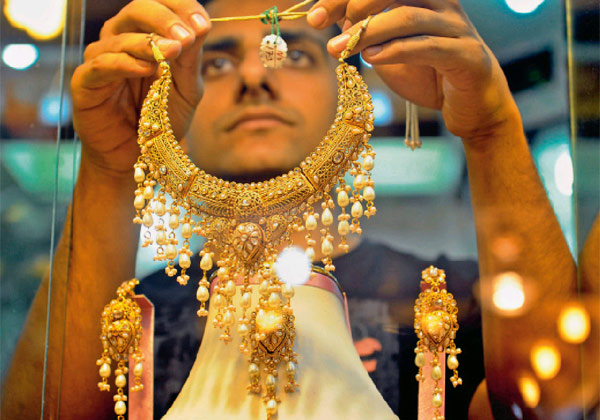

However, stock markets in Europe and the US are at post-Lehman highs. Money centre banks have doubled or even tripled since 2008 on both sides of the pond. There is no sign of either inflation or deflation in the West. So what exactly has triggered this sudden rally in gold? What is going on in the global souks of the yellow metal, Lord Keynes’ “barbarous relic”?

Physical demand in China, India, Vietnam and the Middle East could be one source of bullion demand. China’s financial Ponzi scheme is finally beginning to implode and its shadow banking system is the subprime mortgage crisis of 2014, a catalyst for global chaos. Is gold warning us about an imminent Chinese credit meltdown, as Wall Street, the bond markets and foreign exchange are not? Massive gold index fund selling was the high octane fuel for the gold bear market in 2012-13. Hedge funds have begun to accumulate gold futures on the Comex (Poor John Paulson! Right too early is dead wrong!). The Indian rupee has finally stabilised, albeit at lower levels. Both Chinese peasants and Chinese billionaires are now nervous, with good reason. There is less angst about the Fed taper now it is finally happening. There is even bottom fishing in the NYSE Gold Miners index fund that plummeted 68 per cent in the 2011-13 bear market.

However, I am sceptical that the gold bull market will continue since China’s $3 trillion war chest and the Politburo’s anathema against social unrest makes it highly likely that Beijing will avert a credit crunch via monetary and fiscal stimulus. Moreover, short-term interest rates are only going to rise as the Fed taper morphs into tightening.

This means a bull market in the US dollar, a macro milieu in which gold will be sold once again. This is no more than a trading rally in a bear market. Chicken Little psychology and goldbug conspiracy theories are no argument to buy gold at a time when the world’s finest stock market on Wall Street offers such stellar opportunities. I was bullish on gold in 2009-10 but lost faith in 2012 since the macro smoke signals had turned bearish. My big idea in mid-2012 was to go long Wall Street money centre banks and the Nasdaq biotech bluechips. These shares (Citi, BNP, SocGen, Gilead, Regeneron) have doubled or tripled in value while gold lost 40 per cent in the past two years. Vladimir Lenin said “gold is fit only to pave capitalist latrines”. Lenin’s market call on gold will be refuted if Putin decides to invade a Ukraine that on the brink of civil war. After all, gold once hit an all-time high after the Brezhnev Politburo invaded Afghanistan.