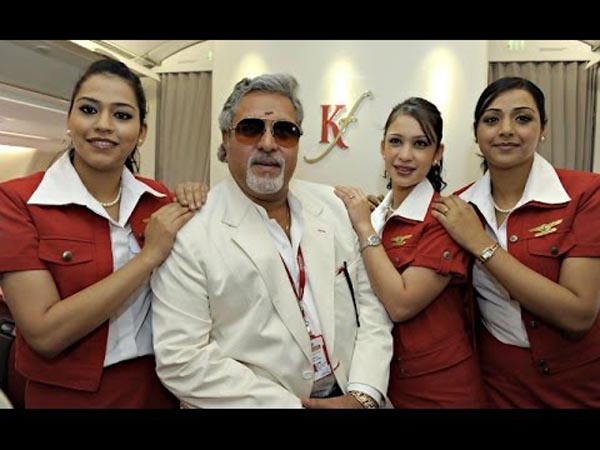

MUMBAI: Private sector banks, which have shied away from tagging Kingfisher Airlines chairman Vijay Mallya a ‘wilful defaulter’ as some key public sector lenders have done, say that they are exploring “all options” to recover their loans.

MUMBAI: Private sector banks, which have shied away from tagging Kingfisher Airlines chairman Vijay Mallya a ‘wilful defaulter’ as some key public sector lenders have done, say that they are exploring “all options” to recover their loans.

At least two banks, the third largest private sector lender Axis Bank and the south-based Federal Bank, have said they have not classified KFA, Mallya and his senior officials as wilful defaulters.

“We have not classified them as wilful defaulters as yet,” Axis Bank executive director in charge of corporate banking V Srinivasan said.

The exposure, declared as bad loan long time back, is very small, he said, adding that the bank had an exposure of Rs 50 crore to the airlines that has not flown since October 2012.

Its peer Federal Bank has also not declared the liquor baron Mallya as “a wilful defaulter”, the bank’s managing director and chief executive Shyam Srinivasan said.

The bank is engaged in negotiations with the airline and is considering “all options” of recourse to recover its outstanding, he said.

The bank has been able to recover around 12% of its total exposure of Rs 90 crore till now, he added.

Country’s largest private sector lender ICICI Bank had sold its Rs 430-crore exposure to an arm of the Kolkata-based Srei Infrastructure Finance. The status on that exposure, which reportedly had the best of collaterals, is not immediately known.

The wilful defaulter tag, dreaded by the industry, is designed to impact the top management’s ability to raise any loan in the future, even in the case of other companies where they hold directorships.