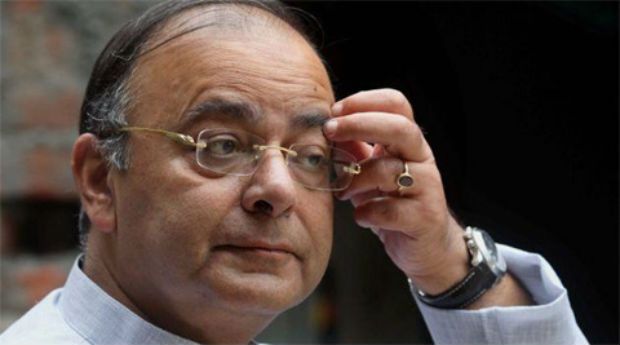

Mumbai: Finance Minister Arun Jaitley on Thursday will present the general budget for the 2014-15 fiscal on Thursday, after the BJP won a landslide victory in May to form the first majority government of the country in three decades. India is also likely to cut gold import duty to 6 per cent to 10 per cent.

The budget is expected to unveil bold reforms in a bid to turn around an economy growing at decade-lows. But there won’t be major changes to taxes, according to a Reuters survey.

NEW REFORMS EXPECTED, MAJOR INITIATIVES:

Announcement of plans to cash in on India’s soaring stock market by selling stakes in major companies to raise funds and bridge the gap between revenues and expenditure.

Cutting giveaways on fuel and petroleum products to reduce India’s $40 billion subsidy bill, which is a key reason for the country’s wide fiscal deficit.

Here are measures that analysts and investors expect for key industrial sectors:

Autos:

Rollout of a goods and service tax (GST) to help streamline and standardise the cost of selling cars

Incentives for exports of vehicles, for free movement of vehicles between states and for getting dated cars off the road

Support to promote and manufacture electric and hybrid vehicles

Financial Services:

Having a roadmap to creation of a holding company for state-run banks

Increase of ceiling on foreign direct investment (FDI) in insurance sector to 49 percent from 26 percent

Tax exemption on long-term infrastructure bonds

Increase in housing loan interest limit beyond 150,000 rupees for tax exemption

Higher allocation for capital infusion in state-owned banks

Tax incentives to encourage expansion of affordable housing

Healthcare:

Tax incentives to spur investment in research and development

Simpler tax norms, including rapid implementation of GST

Increase tax exemption for setting up hospitals

Infrastructure status along with tax benefits

Revive clinical trials in India

Double healthcare expenditure to 8 percent in next 5 years

Infrastructure:

Accelerate dedicated plans for dedicated freight corridors

Open more projects, particularly parts of the railway network, to foreign direct investment

Set up a national fund for infrastructure projects, which could source funds from China or Japan

Roadmap for attracting long-term debt for infrastructure projects

Metals and Mining:

Address issues around mining regulations and adopt reforms for raw material security

Reforms to reduce logistical bottlenecks in transport ofBSE -5.31 % metals and raw materials to and from mines

Introduction of competitive auctions for allocation of minerals and raw materials

Continuation of tax benefits on capital expenditure

Oil and gas:

Reduction of subsidy bill through fuel price reforms

Reintroduce import duty on crude oil

Continuation of diesel price hikes and deregulation of diesel price

Power:

Fast tracking of stalled projects, easier access to power plants and coal mines

Deregulation of electricity prices

Tax concessions and incentives to promote investment into renewable energy

Real estate:

Streamlining of tax laws to enable listing of real estate investment trusts (REITs)

Establishing a single window clearance for speedy project approvals

Grant industry status to the sector, which would lower the risk weightage assigned to it by banks

Increase in tax deduction benefit limit on home loan interest, which is currently capped at 150,000 rupees annually

Retail and consumer goods:

Implementation of GST and tax reforms that will lead to an increase in personal disposable incomes

Announcement of easing of rules on FDI in online retailing

Increase in tax on cigarettes