Maruti Suzuki India, which has come under pressure from institutional investors over the proposed takeover of its Gujarat plant by parent Suzuki Motor Corp (SMC), has tweaked its proposals related to the plant and has decided to seek the approval of minority shareholders for the same.

The decision was taken at a meeting of the company’s board held here.

The meeting was also attended by SMC Chairman Osamu Suzuki.

The board also approved a capex of Rs. 4,000 crore for 2014-15 fiscal, to be used mainly for introduction of new models, marketing, infrastructure and R&D, a company spokesperson said.

The company’s capex for the current fiscal ending March 31, 2014, was about Rs. 3,000 crore.

On the Gujarat plant, the company said although investments at the plant would be funded by SMC via a wholly-owned subsidiary, they would now be done through depreciation and the equity brought in by parent without ‘mark-up’ on cost of production.

Also, in case of termination of the contract manufacturing agreement between them, the facilities of the Gujarat subsidiary would be transfered to Maruti Suzuki India Ltd (MSIL) at book value and not at fair value to be determined by independent valuation as was envisaged before.

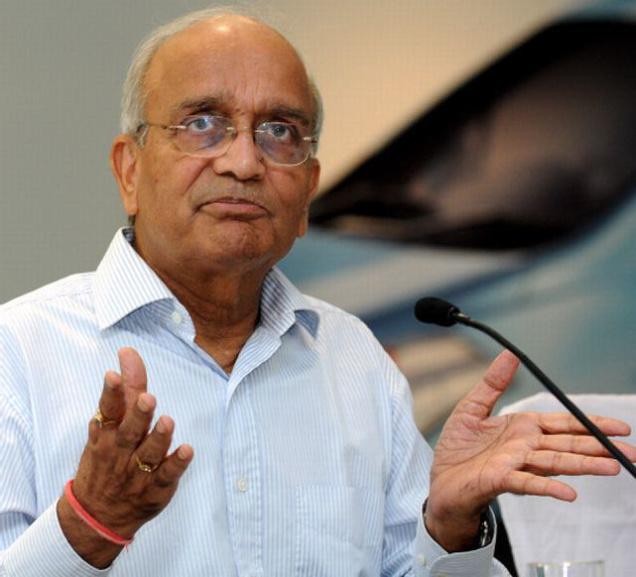

Further, MSIL Chairman R C Bhargava said, “We are not required by law to seek minority shareholders’ approval but the board decided to do so as a measure of corporate governance.”

Expressing confidence that the proposal would be approved by the minority shareholders, he said, “We are hopeful. It’s such a good deal that there is no reason why minority shareholders should oppose it. ”

The company also said that the Gujarat arm would function on the basis that it would neither generate surpluses nor make losses.

In January, SMC announced that it would invest $488 million (about Rs. 3,050 crore) in the Gujarat plant, which was originally proposed to be set up by subsidiary MSIL.

SMC proposed to invest in the plant through a wholly-owned unit, Suzuki Motor Gujarat (SMGPL). The plant, which will be the first fully-owned factory of SMC in India, will have an initial capacity of 1,00,000 units a year, all of which will be supplied to MSIL.

Opposing the move, MSIL’s institutional investors approached capital market regulator SEBI , seeking its intervention to safeguard minority shareholders’ interests. Private sector mutual funds and insurance companies, which own almost 7 per cent of the company, led the opposition.