Mumbai, November 3: In a special session of Muhurat trading on Sunday stock market indices surged ahead as the benchmark Bombay Stock Exchange (BSE) 30-share Sensitive Index (Sensex) ended up at its second consecutive record high of 21,239.36 with a gain of 42.55 points or 0.20 per cent.

Its previous close was at 21,196.81 on Friday. The auspicious Samvat 2070 (new-year) trading witnessed an all-time high of 21,321.53, in a session which lasted for 90 minutes.

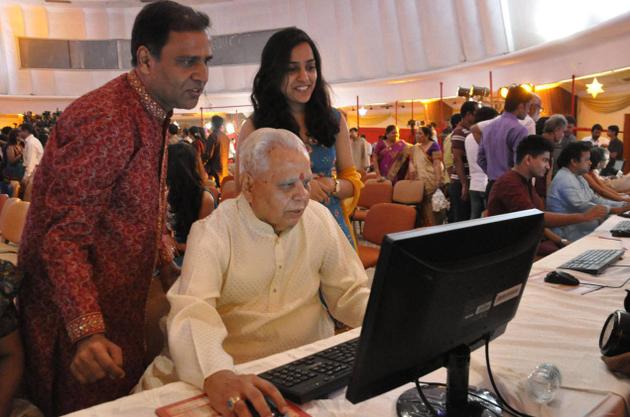

“Market was more in a cheer of festive mood today,” said Deven Choksey, Managing Director, K.R. Choksey Share and Securities. However, “participation from larger players was missing.”

Coming days, according to Mr. Choksey, the major issue the markets watch out would be the exchange rate of rupee which might slip to 63-64 per U.S. dollar as the Foreign Currency Non-Resident (FCNR) account window will be closed by end of the month. “This will definitely create some pressure on the Indian currency temporarily, which may prompt the Foreign Institutional Investors to go slow on infusion of new funds.”

On BSE, a smart rally was witnessed among the mid cap stocks which gained 1.05 per cent and small cap stocks which shot up by 1.37 per cent. Among broader indices, BSE 100 gained 0.27 per cent, BSE 200 was up by 0.33 per cent and BSE 500 gained 0.40 per cent.

The rally was led by PSU stocks which gained 0.78 per cent followed by healthcare 0.77 per cent, automobile 0.75 per cent and fast moving consumer goods 0.61 per cent. Except bank stocks which lost marginally on profit booking, by 0.12 per cent, all other sectoral indices ended in the positive territory.

The 50-share Nifty of the National Stock Exchange closed at 6317.35 up by 10.15 points or 0.16 per cent.

“Foreign flows may continue to support the markets in the near term. We believe that, at the start of the new Samvat, one should adopt a selective approach across sectors, said Dipen Shah, Head of Private Client Group Research, Kotak Securities. However, “the key risks [for the market] are decline in foreign inflows, currency depreciation, spike in oil prices and political uncertainty,” he added.